How International banks are using Robotic Process Automation?

How International banks are using Robotic Process Automation?

International banks are increasingly adopting Robotic Process Automation (RPA) to automate their routine tasks, improve operational efficiency, and reduce costs.

RPA involves using software robots to automate tasks typically performed by human workers, such as data entry, account reconciliation, and report generation. IVEOND has helped many international banks to implement RPA solutions to automate their back- office processes, such as account reconciliation, KYC (Know Your Customer) checks, and data entry. By automating these processes, banks can improve accuracy, reduce the turnaround time, and free up staff to focus on higher-value activities.

Moreover, IVEOND also offers advisory services to banks on how to implement RPA securely and competently. This includes advising on governance, risk, and compliance frameworks and providing guidance on data privacy and cybersecurity.

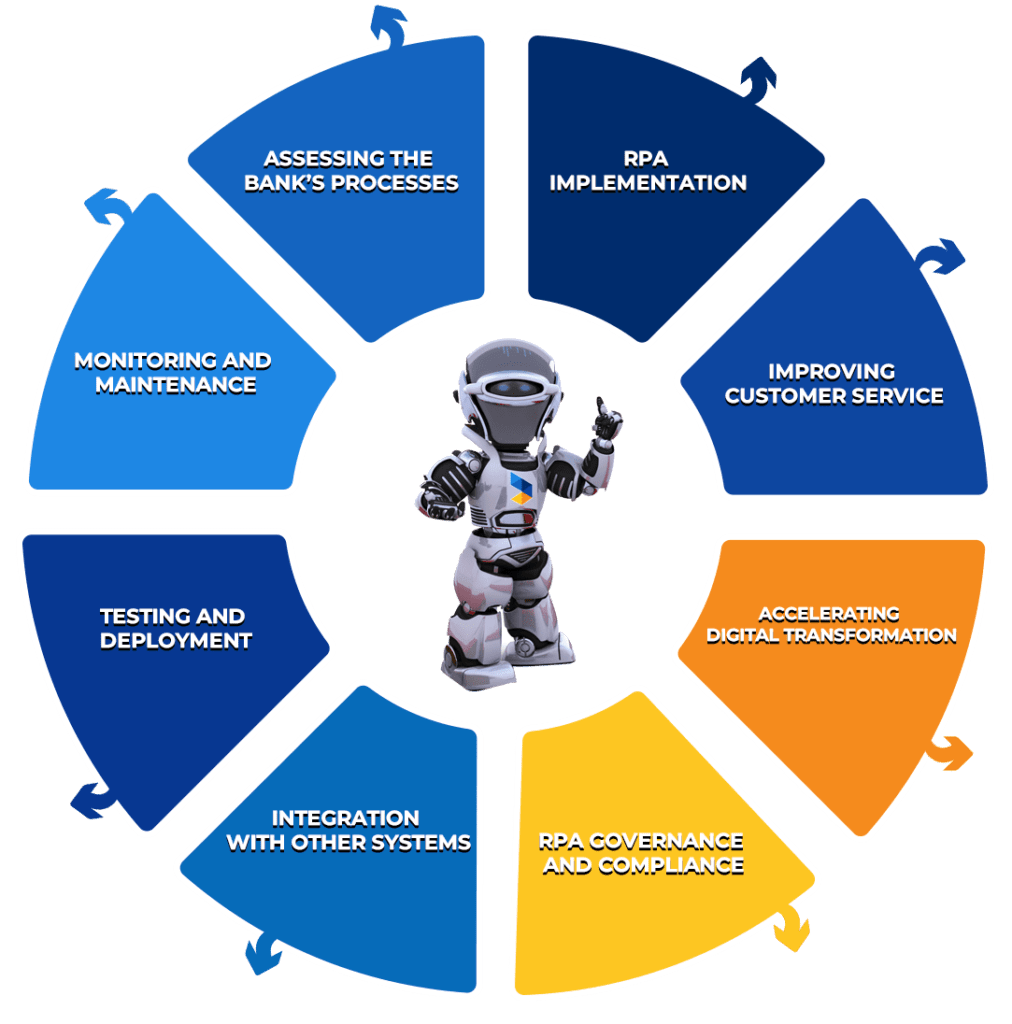

Here are some ways in which IVEOND helps international banks using RPA:

IVEOND works with the bank to identify the most suitable strategies for automation using RPA. This involves analyzing the bank's existing operations, identifying inefficiencies, and identifying opportunities for automation.

We offer end-to-end implementation of RPA solutions, including process identification, design, development, testing, and deployment. They also provide ongoing maintenance and support to ensure the RPA solutions remain effective and efficient.

IVEOND has helped several international banks improve customer service by implementing RPA solutions that automate customer queries and complaints. This has helped reduce response times and improve customer satisfaction.

Our RPA solutions help banks accelerate their digital transformation initiatives by automating business processes and enabling data-driven decision-making.

At IVEOND, we help banks establish an RPA governance framework that ensures compliance with regulatory requirements and market best practices. They also provide training and support to ensure the bank's

employees are equipped to work with the RPA solutions.

We ensure that the RPA solutions are integrated seamlessly with the bank's existing systems, including core banking platforms, CRM systems, and other applications.

IVEOND helps the bank test the RPA solution to ensure it meets its requirements and operates as intended. Once the solution has been tested and approved, we allow the bank to deploy the RPA solution and integrate it into its

existing processes.

After the RPA solution has been deployed, IVEOND helps the bank monitor its performance and provides ongoing maintenance and support to ensure that the solution continues to operate effectively.

RPA is a valuable tool for international banks looking to improve their operational efficiency, reduce costs, and enhance customer satisfaction. Moreover, as technology evolves, more banks will likely adopt RPA to stay competitive in the ever-changing

financial industry. Our RPA solutions are designed to be highly scalable and customizable, allowing banks to automate a wide range of processes across multiple systems and applications. With Oracle’s expertise and support, international banks are better equipped to navigate the challenges of digital transformation and stay competitive in an increasingly complex and dynamic business environment.